Even if you are an over-planner, there are certain things in life you cannot predict, especially when traveling overseas. Imagine you have been planning a cruise for months; you can barely contain the excitement. A few hours before departing, you receive a call that a family member has been rushed to the hospital. When you call the cruise line and explain what happened, they are sympathetic but you are not getting your money back. Company policy clearly states that there are no refunds if you cancel within 14 days of departure. Situations like these are why travel insurance is a must!

Travel medical insurance

Travel medical insurance provides reimbursement for emergency medical expenses, including medical evacuations, while on a trip. These policies do not provide coverage for routine expenses. Therefore, if you break your leg while you are on vacation internationally, emergency medical coverage will protect you. However, if you decide to get teeth cleaning while you are abroad, you will not be covered. Travel medical insurance is meant to protect you only in case of emergency.

Travel insurance

One of the most rewarding parts of travel insurance is the trip cancellation benefits that may be included; you can get reimbursement for prepaid, non-refundable trip costs when you must cancel for a covered reason. Covered reasons are situations like serious illness or injury of the insured person, a travel companion or a family member; the death of the insured traveler, traveling companion or a family member; a natural disaster or another event that renders your destination uninhabitable.

Remember that a vacation is really an investment in your life and happiness. When that perfect vacation starts off with a canceled flight, a missed connection, a missing bag or another travel hiccup, that happy travel feeling begins to fade away. Travel insurance can help make these situations better. Travel delay benefits can reimburse you for additional accommodation/travel expenses and lost prepaid expenses due to a covered departure delay of six or more hours. Baggage delay benefits can reimburse you for the reasonable additional purchase of essential items during your trip if your baggage is delayed or misdirected by a common carrier for 24 hours or more.

Many expats reach out to me and ask me if in my experience travel insurance is the best one for them and their situation. I always recommend expats, frequent business travelers or individuals who spend significant periods of time living outside the United States to purchase a comprehensive health care policy meant for long-term travelers over travel insurance. These policies offer routine medical coverage for those living abroad rather than vacationers.

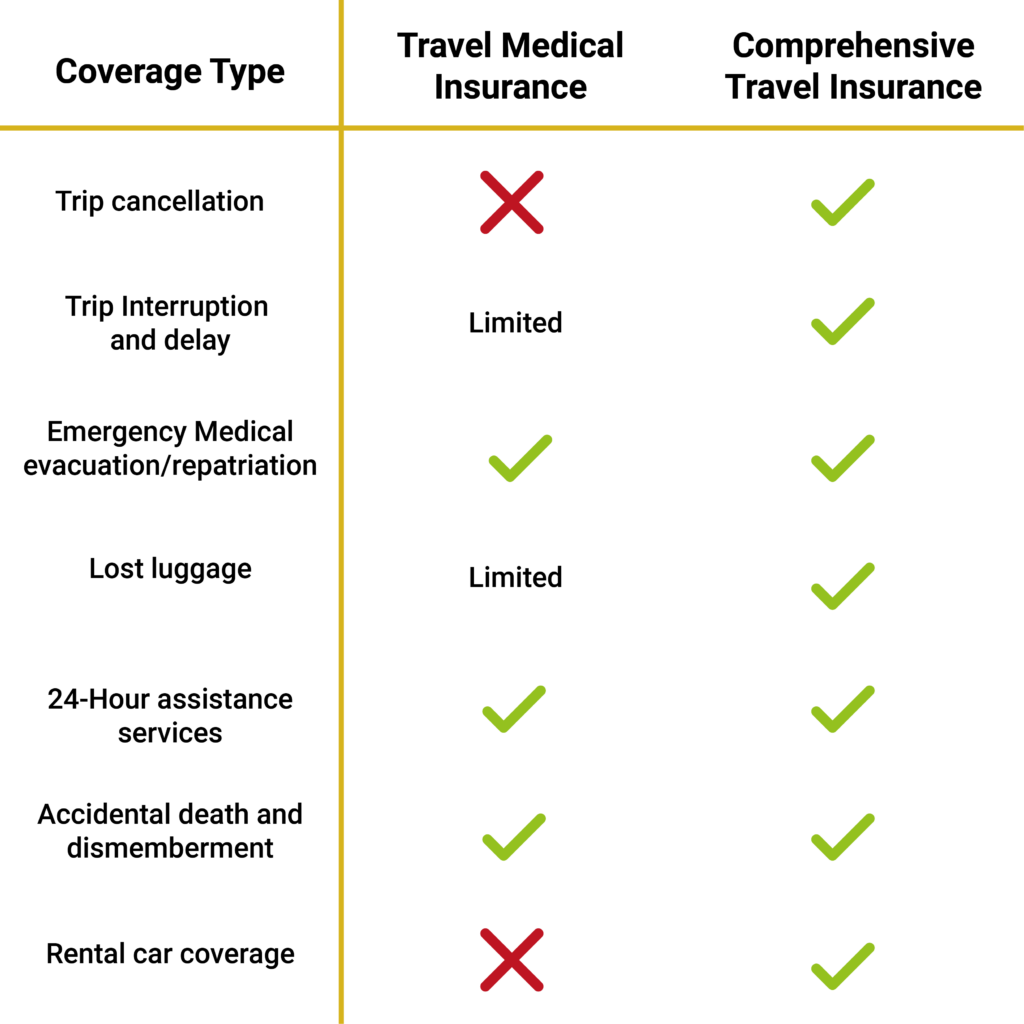

It is very common to confuse these both types of insurance, here is a chart that can simplify the differences between the two so it is easy to decide which one fits your needs better.

Although this is a topic, no one wants to think about, it is important to know your options and always be prepared. Depending on the coverage you are looking for, you can either pick a stand-alone medical policy or get a comprehensive travel insurance one. Deciding what policy is best depends on your situation and any additional protection you may already have through your premium travel credit card or your job. Regardless of which insurance you pick, pick one! Better safe than sorry!